Rajiv Mehta | 12th October 2023 | 5 min read

Welcome to a realm where financial wisdom and family legacy converge – the realm of Family Investment Companies (FICs).

When it comes to securing your family's financial future and leaving a lasting legacy, FICs stand out as formidable tools. There is a lot of hype and wrong news in the industry about these hopefully this article clears any doubts and gives you an insight on how these tailor-made financial entities can shape your family's destiny.

Unveiling Family Investment Companies:

Think of a Family Investment Company (FIC) as a private financial entity crafted exclusively for a single family's financial endeavours.

Rooted in the UK, FICs offer a strategic blend of control, tax efficiency, and growth potential, all tailored to your family's unique vision.

Empowering with Control:

Control is at the core of FICs. Initially, founders hold the reins by utilizing specialized shares endowed with voting rights, steering the company's direction. Family members, often serving as directors, take charge of day-to-day operations, ensuring the family's interests are protected.

Tax Efficiency and Benefits:

From a tax perspective, FICs enjoy dividends with minimal tax implications, making them an appealing option for investing in dividend-yielding assets. Although profits are taxed, this structure allows for efficient wealth accumulation and strategic inheritance planning.

Nurturing Future Generations:

FICs are designed for the long haul. They create a mechanism where wealth remains within the family, promoting a culture of financial prudence and governance. This unique setup prevents hasty financial decisions and allows for the accumulation of capital for future generations.

Crafting the Wealth Journey:

The journey begins with an initial fund injection, often through share subscriptions. Subsequently, shares can be gifted to relevant property trusts, paving the way for tax-efficient wealth distribution. Loans to the FICs or issuing additional shares also form part of the funding strategy.

A Glimpse into a Real-World Scenario:

Imagine a thriving family business in the UK (mum and dad with 2 kids) deciding to diversify and pass their hard-earned wealth to the next generation. Trusts in the UK are only viable up to £325,000 so are no longer the only viable tool for IHT planning.

They establish an FIC, empowering the family to invest in a diverse range of assets – stocks, bonds, properties, and more. Through careful planning and strategic share allocation, they ensure their wealth grows, benefiting each successive generation.

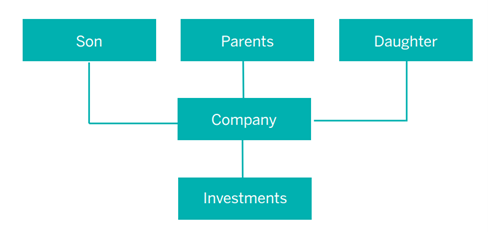

A simplistic view of the FIC would be as below where the parents would fund the initial cash into the company (FIC) where they would retain control but at the same time reduce their taxable estate on death.

Adaptability and Future Outlook:

FICs continue to evolve, adapting seamlessly to changes in tax rates and regulatory landscapes. Once under scrutiny, they have now gained recognition as established vehicles for effective wealth management. Staying vigilant and making necessary adjustments is essential to align with future tax regulations.

In essence, Family Investment Companies are the blueprint for intergenerational wealth management. With careful planning and professional guidance, they serve as a solid foundation for any family aspiring to preserve and grow their wealth while leaving a lasting legacy for generations to come.

At Financial Angels, we have helped numerous clients to achieve the right balance of growth and passing on the family business using FICs and trusts and sometimes in tandem. If you would like to explore this in further detail, please contact us.